WP2 – Market designs & regulations allowing optimal development of flexibilities with high RES shares

![]() Partners involved

Partners involved

![]()

![]()

![]()

![]()

![]() Context

Context

Why should we consider market design when studying flexibility?

The rise of flexibility needs emerges from some deep changes in the electricity industry, such as the growth of short-term uncertainty. Those same changes also question the current European market architecture, which was built upon the assumption that conventional power plants should adapt their generation to an inflexible demand. The context evolution invites us to revisit these core principles.

What will this work package bring on the subject?

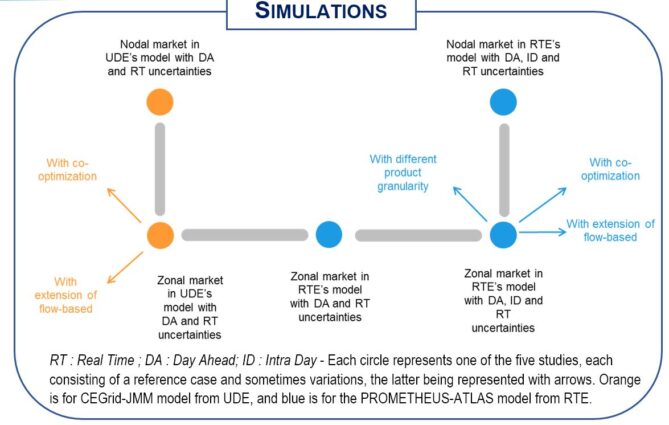

The role of this work package is to propose some market mechanisms that could enable the development of an optimal European mix of flexibility solutions. Five candidates are considered, from specific improvements of the current zonal market, to more a disruptive switch to a nodal market. All five will be tested and compared in five quantitative studies (see the illustration above), using two different models, to then make recommendations. The reason for using two models is because each of them provides complementary features to evaluate how well a market design performs, especially regarding its accuracy and its uncertainty layer (how the information gets revealed and more precise with time to market players), which are key to the evaluation.

![]() Objectives

Objectives

- Explore and propose some market-based solutions for the development of an optimal mix of flexibility sources in Europe

- Create advanced tools and methodologies for market design analysis

![]() WP status (May 2021)

WP status (May 2021)

- Regarding zonal market simulations, the results of adequacy simulations performed with the ANTARES tool using WP1 data were converted to feed the ATLAS model (Agent-based short-Term eLectricity mArkets Simulation). This ATLAS model is run under the PROMOTHEUS tool, inspired from the past European Project OPTIMATE. The first market simulations were produced, providing spot market prices, and are now being analysed and upgraded to consider uncertainties (forecast errors on generation and loads).

- Regarding nodal market simulations, the same process is followed, except more data pre-processing was necessary on the nodal level. The first analysis performed allow to quantify the difference between forecast error at zonal and nodal scale (dependent on spatial granularity). In the meantime, UDE is using other models to perform complementary simulations, exploring in more detail a longer time frame (whole year simulations).

The related deliverables (D2.3 focused on models and D2.4 focused on simulation results) are under preparation

Also, A 4-page presentation introduces the methodology developed by ENSIEL to model the interface between TSOs and DSOs, to better assess the economic potential of distributed energy sources. The approach relies on 1/ modelling the distribution network by using open data only; and 2/ quantifying the availability of flexibility products by using “local market models” that optimize the DERs dispatching. ENSIEL is now testing this methodology on data provided by RTE in order to finetune their models.

Finally, Deliverable D2.1.2 provides an analysis of Key Performance Indicators to assess and compare the performance of possible electricity market designs targeting optimized flexibilities.

Deliverables for download

Deliverables for download

- In Deliverable 2.1 “Methodology for error forecasts”, a new method and algorithm based on copulas is used to generate forecast errors on load and RES generation time series. The method uses real forecast data to learn and reproduce some hourly updates on load and RES generation forecast.

- Deliverable 2.2 “Candidate market mechanisms” gives a comprehensive review of existing market designs and lists the candidate market designs selected for in-depth study in the project: the two references are Power exchange with zonal pricing and Power pool with nodal pricing. For zonal market, variations will be tested like different product granularity or the co-optimisation of energy and reserve.

- Deliverable 2.3 « Models for market mechanisms simulation taking into account space-time downscaling and novel flexibility »

- Deliverable 2.4 « Quantitative analysis of selected market designs based on simulations »

- Deliverable 2.5 « Recommendations for market designs and regulations »

- Deliverable 2.1.2 KPIs measuring the value of flexibility

- Milestone 2.2 : First market simulations available.

- Milestone 2.3: Improved methodology to represent flexibilities on the distribution grids from a transmission grid point of view